“Normal is Broke – Be weird” – Dave Ramsey

“If you will live like no one else, later you can live and give like no one else.” – Dave Ramsey

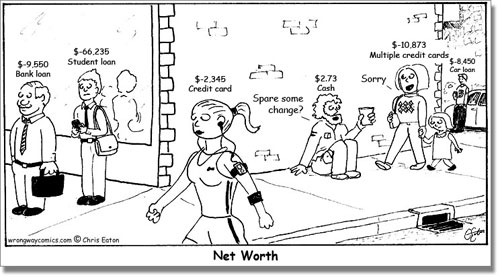

Emotional Financial Maturity

Knowing the math and what you’re supposed to do is totally different than actually doing it. I knew all of the right financial math before most bad financial decisions that I’ve made. But, I still had emotional baggage and bad habits that made it impossible to follow the math, even when I knew better.

“I want to do what is good, but I don’t. I don’t want to do what is wrong, but I do it anyway.” – Apostle Paul

It is amazing what sort of twisted reasoning we humans are capable of when we want or “need” something. If you have ever used the word “deserve” in your decision-making process, this topic right here is for you. Let’s work that out. Because usually, that is coming from some sort of false pretense that is going to have you making financial business decisions based on things that are not logical.

Personal Pain Example: My brand new Daytona Blue 350Z gave me the “confidence” that I needed to be successful. Total garbage. It was a snap decision to buy it. The best thing that ever happened to me was to drive that car to a grocery store and then 20 minutes later go to the same store in my $600 beater of a pickup truck. I realized quickly that I was exactly the same person as 20 minutes ago and the superficial security in how strangers in the parking lot looked at me was worthless. If a car or some outside material thing makes that much of a difference for you, then spend some time working out why that is. It’ll make a huge difference in your life.

Personal Financial Issues and Personal Debt can Hurt your Business

I have run a business when I had debt and I have run a business when I didn’t have debt. In both situations, my monthly expenses were similar, very low, but the time I did it with debt was way harder. I think this had more to do with personal financial maturity than anything. If you are running a small business, banks will always look at your personal financial situation before extending your business a line of credit. You have to have three to five highly profitable years as a business before banks will stop asking you for personal collateral on any business loan. So that student loan, medical debt or tax debt that you have? yeah, that’s going to factor into whether you get a business loan or not. Here’s why, if you are not disciplined enough to manage your personal finance, then why would any banker or creditor believe that you’ll have disciplined habits when it comes to your business finance?

How to Improve your Financial Maturity Before Starting a Business:

- Pay off all of your personal debt, all of it – get debt free – do it! Doing this demonstrates that you probably have a lot of the stuff later down this list in the bag. Being debt free is one of the most liberating feelings I’ve had in my life. It changes the game.

- Lower your personal expenses

- Pay cash for your car

- Own or rent a home that is below your means

- Prioritize 1 or 2 areas where you splurge so that when you do, it’s fun, but you spend less money overall

- Have a personal emergency fund so that you never have to take out an “emergency loan” or “extra paycheck” from your business

- Get used to saying “NO” when you are asked to spend money – once you own a business, you become a target of a whole new level of sales and marketing. You’re not just asked if you’d like to “invest” in some new $5k items or plans, you’re asked if you’d like to invest $60,000 on a new business whizbang. You need to be very stingy and structured with your business money.

- Get rid of any inclination to make impulsive financial decisions. One of the primary tactics used in sales and negotiation is to invoke the fear of missing out (FOMO). Any serious business vendor or opportunity is going to give you time to decide. If your business is in one of the rare exceptions to this, get a systematic and fast decision process in place. There are many good opportunities out there, but not all of them are the BEST use of your time and money. Be good at making the “good” or “better” distinction.

- Make sure your significant other is on board with your business financial strategy. If not, make sure you have an agreement to keep them separate or make someone else the primary financial decision maker for your business. Your business partner or outsourced CFO won’t care about your SO’s pouting and hissy fits. If you are the one who throws the hissy fits, fix yourself first.

There is More Than one way to do This

Unpaid plug: My wife and I went through Dave Ramsey’s Financial Peace University together. It was one of the most liberating and life-changing journeys to put us in the position for success. Dave focusses on emotional financial maturity and a common language for spousal communication that is invaluable. Now that’s we’ve improved on a bunch of the items above, we’re in an incredible spot to support each-other in financial business situations.

Some people are able to run a successful business without the items above. That’s OK. This is just the way that has made the biggest difference for me personally. You have probably found or heard critics of Dave Ramsey. Most of those are critical of his investing advice. None of what I’m talking about above has anything to do with that… this article is purely focused on emotional financial maturity. There are several business debt scenarios and topics on this site that will contradict Dave Ramsey’s no debt approach. The key here is this: Separate Personal and Business finance.

Good reading:

Leadership and Self Deception – The Arbinger Institute

https://www.daveramsey.com/fpu