When an idea first comes to you, in the shower, in a dream, while you’re on a run, or while you’re at work, one of the key things you want to be able to do is quickly estimate if it’s a good idea financially. This business case feasibility study is focused just on that, is it in the ballpark of being a good idea?

Down the road, during the formal business case development, the financial model should get much more involved than this.

How to Decide what to do with the Results of the Financial Business Case

The results of this analysis are supposed to give you a feel for the feasibility of an idea. This should give you the start of financial justification to continue working on an idea. There are four possible outcomes of this analysis:

- This is a GREAT idea, all the financials look awesome

- This is MAYBE a good idea, but it’s not as clearly awesome as we hoped

- This is a TERRIBLE idea and will lose tons of money

- We don’t have enough information yet

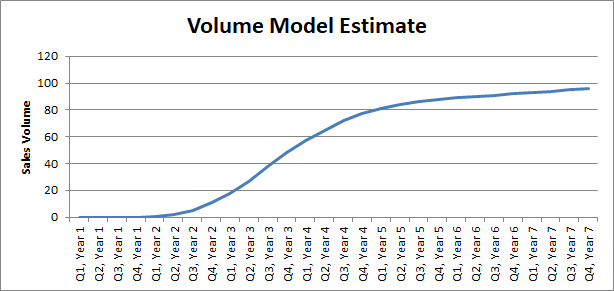

Quick Volume Modeling

In order to make this quick, I tried to build in some volume growth models. These models should let you choose a growth function, some timing items, and a few other details to get something that “looks right”. Put in an average price and then roll on down the rows to estimate expenses. The model will spit out NPV and Actual and Discounted Breakeven Time and Sales and Return on Investment. It’ll even give a ballpark for the Investment needed.

Business Case Financial Feasibility Template:

Business Case Financial Feasibility

In the template there are two tabs. Start with the Volume Model tab and choose the sales volume that seems the most correct. If none of the models are giving you what you expect, then use the “custom” option and insert your own sales estimates. Sales volume is one of the most critical factors to get right to have a reasonably accurate prediction.

The second tab focuses on expenses and the rest of the things which may influence financial metrics. Use your own knowledge or try to find SEC Profit and Loss filings for companies that product a similar product. There are a lot of comments in the template to try and help with some of the concepts used in the sheet, so check those out as you go.

Discounting Future Cash Flows

The Discount Rate is a concept that is heavily used in financial cases. The concept is that money today is worth more than money in five years. The common way to determine what future money is worth is to determine what the capital tied up into the investment is costing you and use that as the base rate with add-ins based on the risk level of the investment. This is known as the Weighted Average Cost of Capital (WACC) and the Risk-Adjusted Discount Rate respectively.

In these templates we take many of the simple financial metrics, such as ROI and Breakeven and add in discounting. This is a more difficult metric to calculate, but it is more useful. Since the discounted numbers are already calculated for you, be sure to use the numbers that are the most meaningful in your decision making.

Financial Metrics for Decision Making:

Before we start, I’ll briefly describe what we’re trying to determine so we know the end game before we start. Each of these financial metrics are trying to help decipher if this is a good idea or not. Some are more intuitive individually and some are more focused on comparison between multiple ideas.

Net Present Value (NPV)

The Net Present Value (NPV) uses the Discount Rate to determine what all future cash is worth in today’s dollars. If your discount rate is 15%, then $1,000 next year is worth $850 in today’s dollars. The NPV is the sum of all discounted cash flows over the period of the financial case.

We want the NPV to be more than zero at a minimum, and as high as possible. This is the most direct way we have to predict the amount of profit that an investment might make for you.

Estimated Investment Needed

This isn’t a formal cash flow evaluation with inventory financing or an investment timeframe evaluation, but it’s a quick idea of how much capital investment it’s going to take to pursue this opportunity. This estimate is the lowest amount of cumulative cash flow that occurred in the model. This number needs to be refined further in the future since cash flow is one of the top reasons for business failure. But for now, it’s a reasonable ballpark to start with to understand if you have enough money to pursue.

Breakeven Time

The breakeven time is the projected time that your investment will be net zero. This means that you’ve made back all of your investments with the profits from the investment. You should pay the most attention to the Discounted breakeven because it determines when your investment pays you back including the cost of capital.

We want the breakeven time to be as soon as possible. Longer timeframes for return usually mean higher risk and uncertainty. This also means you’ll have capital tied up into the investment for longer. The sooner you get your investment back, the sooner you can invest in additional opportunities.

Breakeven Sales

The breakeven sales is an approximation of the number of units you need to sell for your investment to be a net zero. Any additional sales beyond this approximate number will begin to build profit. Again, you should pay the most attention to Discounted numbers.

We want the breakeven sales to be as low as possible. The lower this number is the less risk there is associated with understanding your market or having production issues. If it ends up being harder to produce and sell units then a lower number here means it’s not as big of a deal.

Return on Investment

The return on investment is a ratio that says how much money you’ll make back for every dollar you spend. If you have limited cash reserves, you want to invest in an opportunity with a higher return. ROI is primarily focused on comparing opportunities and trying to choose the best one.

very good submit, i actually love this website, carry on it