Have you ever had a customer who is late to pay you? It is SO FRUSTRATING!!! You’ve done all the hardest parts: Marketing, getting a customer, and actually delivering all while surpassing expectations. Then you send them an invoice and it just gets awkward and it seems like they hate you all of a sudden. Even though you’re the best supplier ever! Invoicing is usually the biggest part of struggling Accounts Receivables which really hurt your overall Cash Flow. So Let’s Fix it!

We use words like Psychology and Benefit that might seem out of place when it comes to invoicing. Bear with me, because we people aren’t as logical as we think we are! So we’ll use some straightforward tactics and we’ll use some psychological tactics. The point is that if you have late or non-paying customers, something needs to change!

1. Communicate Value and Benefits When You Itemize

Some of the work you do is directly benefiting the customer and some of it is not, but has to be done, and you need to be paid for it. In Six Sigma we call this Non Value Added but Necessary. So when you’re invoicing, make sure you focus the line items on the value-added activities or benefits to the customer. Then put the non-value-added-but-necessary items in the price of the benefits that it was leading up to. Don’t lie about it, but make sure you’re focusing on what value was delivered instead of just saying that you spent 62 hours analyzing data.

2. Update Your Invoices EVERY DAY!

Get in the habit of updating the invoice as you do the work. Waiting means it’s going to take you longer to remember what you did and harder to put down exactly what happened. You are much more likely to undercharge if you wait. As an added bonus, you look very professional if you can respond quickly when your customer asks you about invoice status.

3. Invoice Sooner Than Later

Sending an invoice immediately makes sure the customer remembers the value of what you did when they receive the bill and it starts the clock on payment incentives. Waiting three weeks to send an invoice is just a horribly inefficient process and an unnecessary ding to your cash flow. < link!

4. Re-State Contract Terms on the Invoice

Make sure there is a section in the contract that says what your agreed payment terms are, such as invoicing frequency, payment expectations, payment method, or late payment fees. Make sure you reference the contract that you have on the invoice. Keep in mind that quite often the bookkeeper is doing invoice payments in a silo, so doing this will make it less likely to be kicked up the chain for approval.

5. Do the Paperwork Right Ahead of Time

54% of UK companies in a survey said that invoices were being sent to the wrong place!

Make sure you use the right billing address. Some companies require specific items on any invoice that comes to them, such as a purchase order number, EIN, specific part numbers or descriptions of services. Any company that has this requirement should be able to provide you with a written policy that says what is needed. Make sure you get a copy of their invoicing terms to avoid the processing feedback loop.

6. Use Invoicing Software

Many accounting software packages have an invoicing process. Just make sure you are using that feature. Alternatively, there are lots of free options that you can find by searching for free invoicing software. I have even used a Word template with my Logo.

7. Use The Psychology of Color to Communicate Trust

Different colors are perceived to mean different things. Blue tends to convey competence, quality and corporate. Green conveys good taste and growth. Red conveys excitement and power. In fact, the color red seems to evoke a faster response time than blue or black. Don’t get too crazy with color, but consider if you can look professional and mix in some coloring such as a dark blue font instead of a black font with a red price. Get creative and make sure you have someone double check that you’re not going too wonky if you’re not a designer.

8. Use Pricing Psychology to Make the Invoice Amount Seem Lower

You can use some psychological pricing tricks to make the dollar amount on an invoice seem smaller than it is. Yes, this stuff is legit. For real.

- Display prices in small font size compared to the benefits itemization

- Put the prices on the left (we associate left with smaller and right with bigger)

- Remove the commas from the prices

- Remove the currency symbol

- Display prices in red when you know men are doing the paperwork

- itemize shipping or other “pass-through” types

- If you’ve discounted anything, make sure you have the full price and discount on the invoice, put the discounted price directly to the right of the original price and have a reason for that discount

9. Say Please and Thank You!

Your mother taught you better than that! Saying please and thank-you on the invoice has been proven to increase your chances of getting paid. In fact, say this exactly: “Thank you for your business, please pay within 21 days”.

10. Calculate the Actual Date Due

You should do the math for your customer so that it’s clear what day you think is the due date. This avoids any issues with calculating or miscalculating the date. Make it as easy as possible for them to pay you!

11. Use Email, Electrons are Faster and Than Snail Mail!

People check their mail one time a day but check their email hundreds of times per day. Send your invoices by email instead of by postal service. This will cut out at least two days’ worth of shipping time and probably reduce the amount of time it takes for your customer to process the paperwork. You can set a policy that says you don’t do paper invoices just to enforce this. You can even call it a “green initiative” (wink wink). You can also include a link to an online payment portal.

12. Incentivize Early Payment

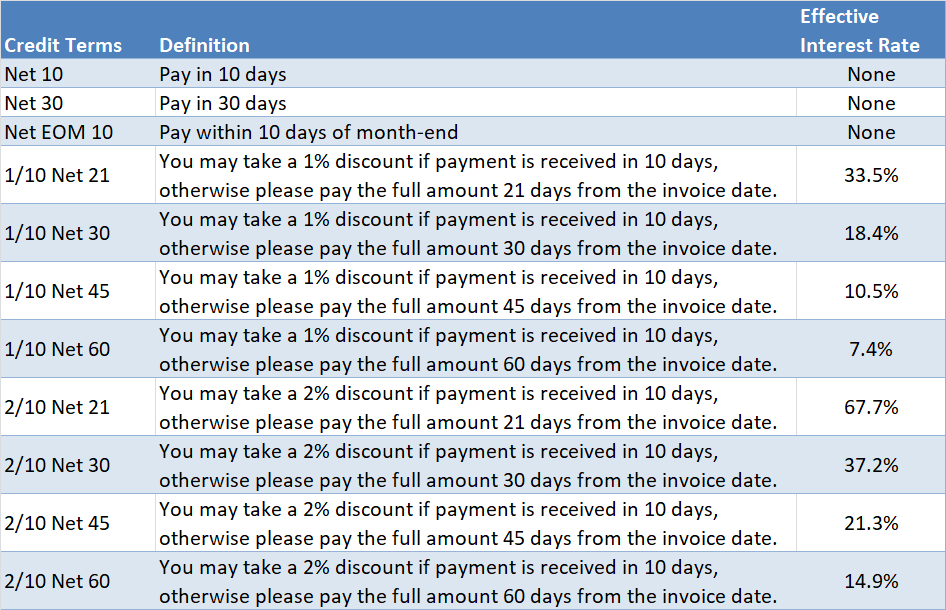

It may be worth adding an early payment incentive such as a 2% discount for paying within 10 days of the invoice date. 2%/10 net 30 means that you will discount the invoice by 2% if you receive payment within 10 days of the invoice date. The only issue with doing this is that the effective interest rate bonus of 2% net 10 is equivalent to 37.2% APR, which is exactly why it works. I included a table below illustrating common Credit terms and a calculation of the effective interest rate. Keep in mind that you can put these terms on a sheet, but you need to balance that with being polite and using plain English as we stated earlier.

13. Charge a Late Fee

It costs you money when your customers pay late. So charge them for it. It is a standard business convention to charge for being late, so customers should not be surprised if you charge a late fee. 58% of UK Companies in a survey said they paid late fees.

You should charge a rate that is higher than a bad credit card, and higher than your cost of capital. Being late might put you out of business. Being late on payment is unethical at best and a violation of your contract terms at worst.

14. Build a Document Trail

Track when you sent invoices, when terms changes occur and when any interactions on an invoice or payment have occurred. There are many tracking systems available for this if you get to a point where the cost is justified.

15. Re-Send Invoices Regularly

Make sure you stay at the top of their mind. Re-send the invoice so it arrives right before payment is due. Send it again on a regular basis and make sure you send a “past-due” notice in big red letters if they are late.

16. Offer Multiple Payment Methods

The more ways you have for someone to pay you the better chances that they’ll pay right away. Make sure you give clear directions on how you can be paid. If a customer needs a specific way to pay, then try to be accommodating. In the event that you don’t normally accept a specific method, but a customer specifically wants to use it, you may be able to include a processing fee for having to do the setup work.

You Decide

Choose 3 of these to do right away. Then watch for which ones improve your Receivables statistics and keep doing the ones that work.

Thanks for every other fantastic post. Where else may just anybody get that type of information in such a perfect method of writing? I have a presentation subsequent week, and I’m on the search for such information.

I like the helpful info you provide in your articles. I will bookmark your blog and check again here regularly. I’m quite certain I’ll learn many new stuff right here! Best of luck for the next!

This is really interesting, You’re a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your fantastic post.

Also, I’ve shared your website in my social networks!

Touche. Great arguments. Keep up the good work.

Hello! This is my first visit to your blog!

We are a collection of volunteers and starting a

new project in a community in the same niche. Your blog provided us

valuable information to work on. You have done a extraordinary

job!

I’ve read some good stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to make such a fantastic informative website.

Hurrah! After all I got a web site from where I know how to genuinely get valuable data regarding my study and knowledge.

Way to go on this post man. Really killer stuff. I’ll be back to read your other posts.

“This is a realy useful post, thanks_for that!”

Wow! This can be one particular of the most helpful blogs We’ve ever arrive across on this subject. Actually Magnificent. I am also a specialist in this topic therefore I can understand your effort.

I’ve been absent for some time, but now I remember why I used to love this website. Thank you, I’ll try and check back more often. How frequently you update your web site?

Some genuinely nice stuff on this website , I love it.